40+ can you get a mortgage if you owe taxes

Lock Your Rate Today. Web A 40-year mortgage is like a traditional 15- or 30-year mortgage but offers an extended payment term.

How To Apply Georgia Mortgage Assistance Fund 354 Million 11alive Com

Web You can get a mortgage and buy a home when you owe taxes but you may need to make progress on your tax debt in order to convince a bank to approve your.

. 2018 you can deduct. Web The 40-year mortgage typically comes with a fixed interest rate which might be best for buyers who have a desire to put down long-term roots but are also on a tight. NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You.

Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every. Save Time Money. Web Even if you dont owe taxes filing a return may be well worth the effort.

Web For example for the 2017 tax year if you deduct 10000 of mortgage interest and you fall in the 35 percent tax bracket your tax liability drops by 3500. With a balance due above 10000 you can qualify for a streamlined installment plan. If you do not pay your taxes in time after the IRS has assessed your tax.

While homeownership is a goal for many people owing taxes to the IRS. Get Instantly Matched With Your Ideal Mortgage Loan Lender. Web Whether youre a business owner or a self-employed individual you can buy a house even with a tax lien.

VA Loan Expertise and Personal Service. Lock Your Mortgage Rate Today. Web Balance between 10000 and 50000.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Lock Your Rate Today. Web If youre making payments on the tax bill you will need to show the mortgage lender your payment agreement.

Compare the Best Home Loans for February 2023. Get Instantly Matched With Your Ideal Mortgage Lender. You can deduct mortgage insurance premiums mortgage interest and real estate taxes that you pay during the year for your home.

Federal minimums range from 10275 to 20550 for the tax year 2022 11000 to. Apply Get Pre-Approved Today. Web If youre hoping to buy a house but currently owe taxes you may be wondering if the path to homeownership is even possibleAlthough you can buy a house.

Web The IRS places several limits on the amount of interest that you can deduct each year. Apply Get Pre-Approved Today. Contact a Loan Specialist.

Compare the Best Home Loans for February 2023. Most lenders will want to see a solid history of payments if. If your DTI is 44 without the IRS monthly payment determine how can pay and.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. For tax years before 2018 the interest paid on up to 1 million of acquisition. If a homeowner remains in the property for the life of the loan.

Get Started Now With Quicken Loans. It Pays To Compare Offers. Web Estimate how much youll owe in federal taxes for tax year 2022 using your income deductions and credits all in just a few steps with our tax calculator.

Were Americas Largest Mortgage Lender. Compare Mortgage Options Get Quotes. Web A smaller monthly payment will impact your debt-to-income DTI ratio the least.

Get Your Quote Today. While acceptance isnt guaranteed the. However you may struggle to get a mortgage with good terms and some lenders arent willing to work with people.

Web A tax lien is a legal claim to your property the government can place when you fail to pay your tax debt. Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Determine Your Eligibility Status with a Trusted VA Loan Lender.

Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. If you get a 100 deduction you only save a percentage of 100. Web Yes you can buy a house if you owe back taxes to the IRS.

However if your back taxes add an additional significant debt on top. Web If you owe 1000 and get a 100 tax credit your tax bill drops to 900. Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best.

Web A 40-year fixed mortgage is a mortgage that has a specific fixed rate of interest that does not change for 40 years. Find The Right Mortgage For You By Shopping Multiple Lenders. Answer Simple Questions About Your Life And We Do The Rest.

Get Instantly Matched With Your Ideal Mortgage Lender. If you choose a 40-year fixed mortgage your monthly payment. Web If your back taxes are significantly outweighed by your assets then this will not hurt you during the process.

How Much Savings Should I Have Accumulated By Age

Can You Get A Mortgage If You Owe Back Taxes To The Irs Jackson Hewitt

Tax Lien How Does Tax Lien Work With Example And Impact

Can I Buy A House Owing Back Taxes Community Tax

Can I Get A Mortgage If I Owe The Irs Money For Back Taxes

High Earner Pay Off Your Mortgage Twice As Fast Saltus

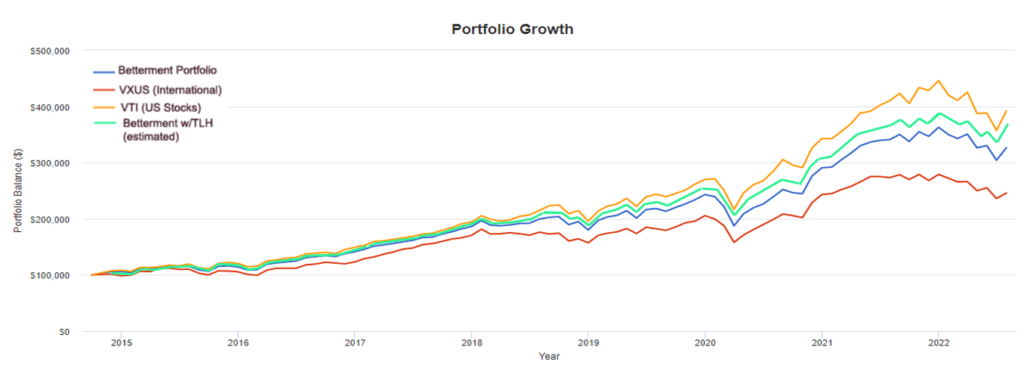

The Betterment Experiment Results Mr Money Mustache

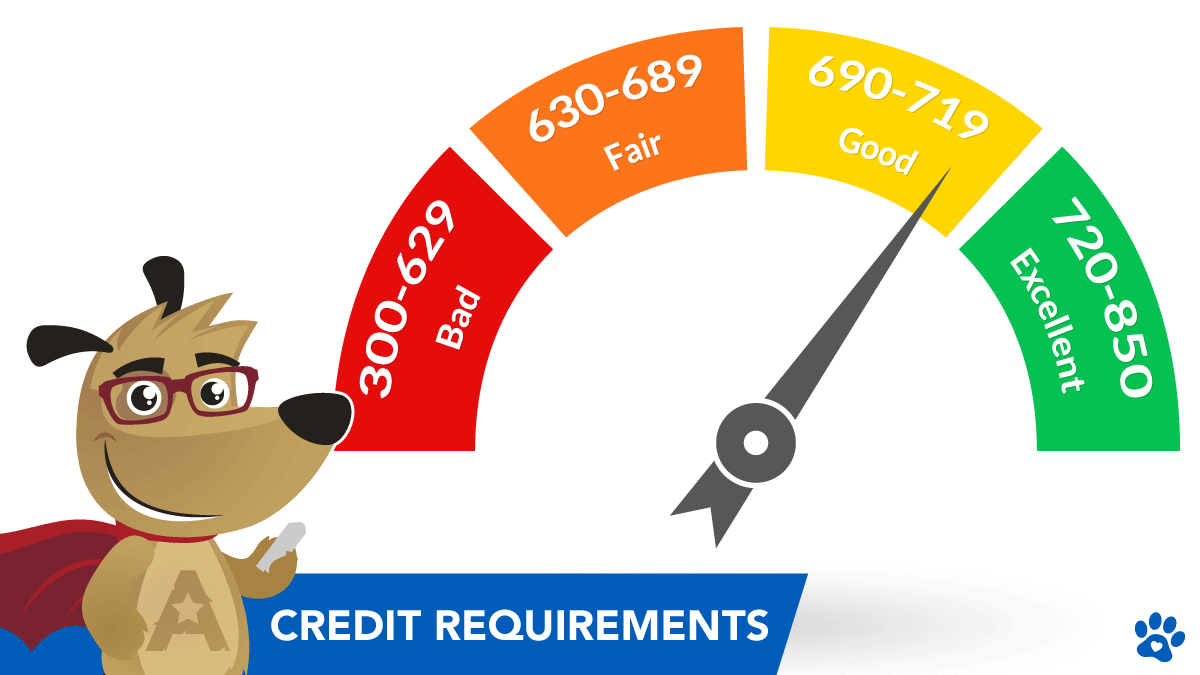

Credit Requirements For A Reverse Mortgage In 2023

Adult Children When To Help And When To Let Them Learn Wehavekids

Top Tax Benefits Of Home Ownership

How Much Should I Have Saved In My 401k By Age

Besides The President Who Pays No Taxes Go Curry Cracker

6 Ways To Get Approved For A Mortgage Without Tax Returns In 2023

You Don T Have To Pay Your Back Taxes To Get A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

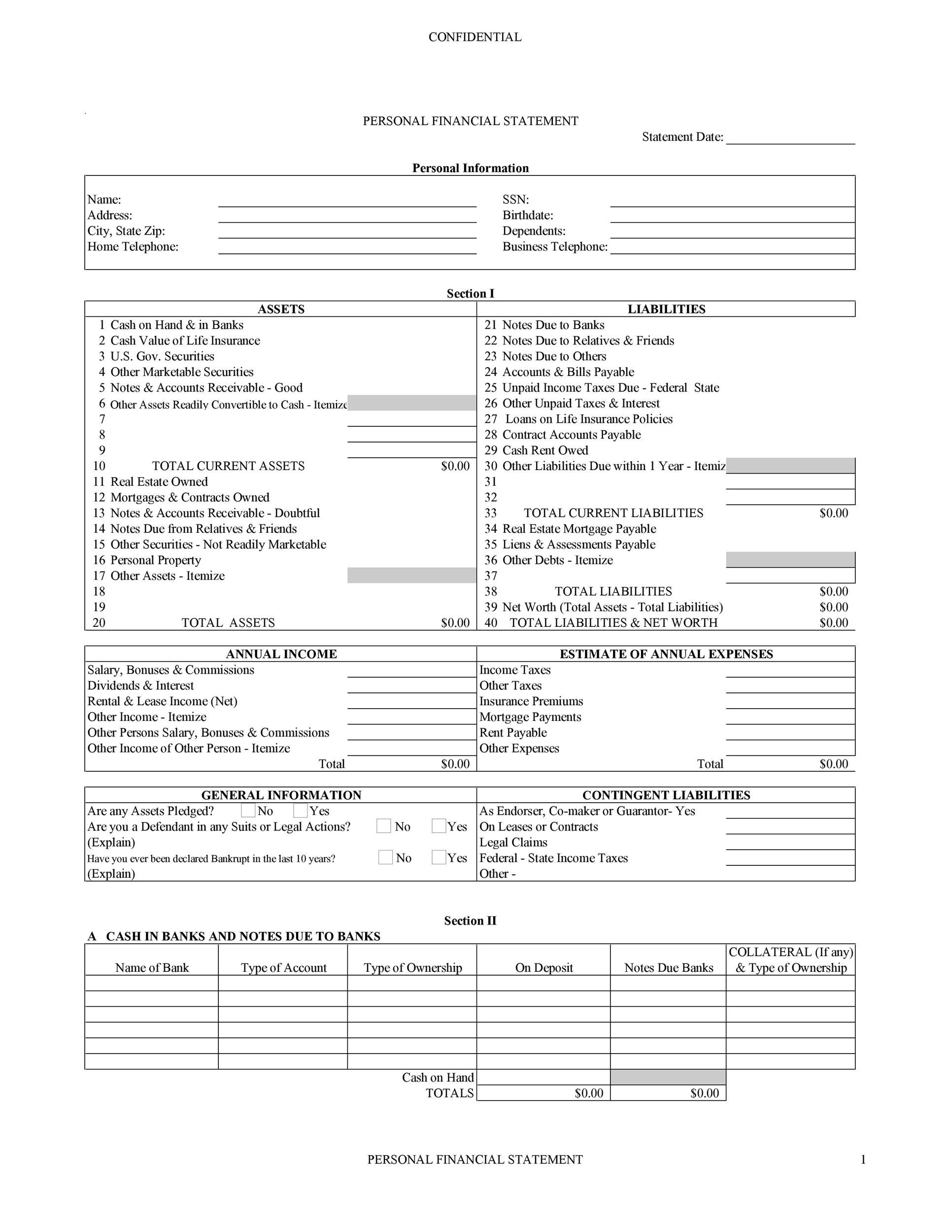

40 Personal Financial Statement Templates Forms ᐅ Templatelab

Can You Buy A House If You Owe Taxes Credit Com

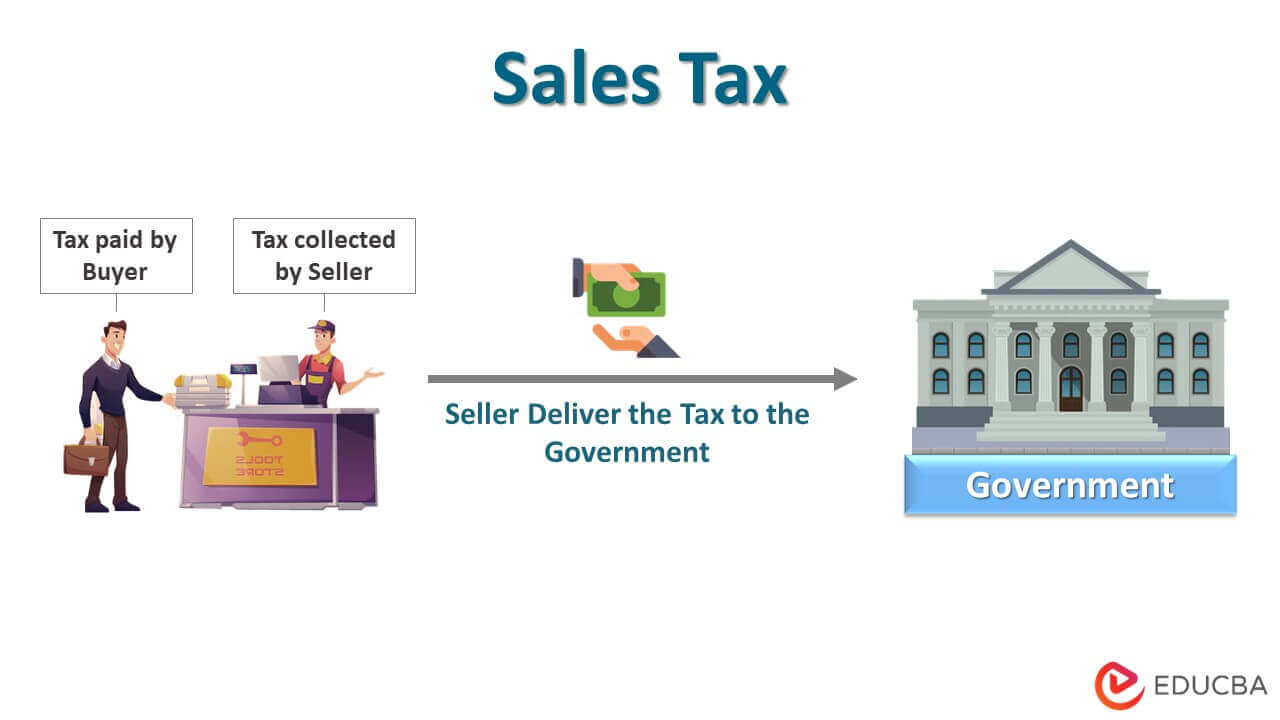

Sales Tax Types And Objectives Of Sales Tax With Examples